Banking

Banking includes a wide variety of financial institutions that store the money of individuals, businesses, and other entities. Banks provide financial services that help people save, manage and invest their money.

What is banking?

Banking is the business of protecting money for others. Banks lend this money, generating interest that creates profits for the bank and its customers.

A bank is a financial institution licensed to accept deposits and make loans. But they may also perform other financial services.

The term “bank” can refer to many different types of financial institutions — including bank and trust companies, savings and loan associations, credit unions or any other type of institution that accepts deposits.

Types of Banks

There are several types of banks, typically grouped into a category based on the type of business they perform. Banks in a certain category offer similar services.

Some banks may focus on consumers while others focus on investments, corporations or other sectors of financial services. Whether you are looking to manage your personal finances or grow your business, here is a list of common types of banks unique to every need.

Retail or Consumer Banks

Credit Unions

Savings and Loan Associations

Commercial Banks

Community Development Banks

Investment Banks

Online-Only Banks

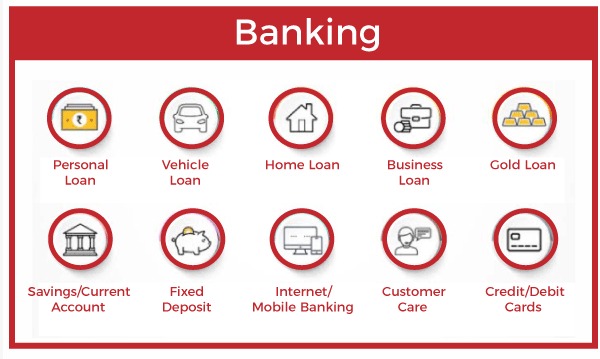

Typical Services Banks Offer

Different types of banks provide different services tailored to their customers. There are some relatively common banking services and products that are both tailored to individuals and widely available through virtually all consumer banks and credit unions.

Checking Accounts

Savings Accounts

Certificates of Deposit

Money Market Accounts

A money market account allows you to earn higher interest rates than traditional savings accounts. However, they may require a minimum deposit and require you to maintain a minimum balance. Money market accounts typically come with FDIC or NCUA insurance protection, debit cards and check writing abilities.

Loans

Consumer banks provide several different types of loans. These include personal loans to cover unexpected expenses, auto loans, home equity loans and personal lines of credit.

Debit Cards

Debit cards are connected to your checking account, allowing you to swipe the card at a business and pay for goods or services directly from that account. They may be more convenient than carrying cash, but you may be on the hook for charges to the card if it’s lost or stolen. Check with your bank about its requirements.

Credit Cards

Banks issue credit cards to allow you to make purchases on a line of credit. You borrow money from the bank each time you use the card, with the promise of paying it back. You pay interest on these charges unless you pay your credit card fee in full each month. You may also pay a fee to use the card.

How to Choose a Bank?

Choosing a bank that’s right for you depends on the type of financial services you need, the interest rates the bank pays you for deposits, the interest rates it charges for loans or credit cards, other fees and overall convenience.

Things to Consider When Choosing a Bank

Services You Need

Know what financial services you want from a bank and focus on banks that provide that type of service or offer the financial product you’re looking for. For most individuals, that may mean a commercial bank, but also consider a credit union if you qualify for a membership in one.

Fees

Look for low or zero fees. Fees can vary widely depending on the type of banking product or service, as well the bank. Typical fees include monthly maintenance fees for each account, credit card fees, ATM fees, overdraft fees, early withdrawal fees for CDs, overdraft fees if you spend more than is in your account and fees for other products or services. Check on all potential fees before you open a new account.

Location

Make sure the bank has locations convenient for you. Find out if it has branches near where you live, work or travel frequently. Check to see if it has ATMs where you need them, so you can avoid ATM fees. Also, consider how convenient an online-only bank may be for your lifestyle.

Reputation

Read reviews of the banks and credit unions you’re considering. Compare ratings on customer service and whether you’ll benefit from the products and services they offer. Most people typically stay with the bank they choose for a long time. Make sure it’s a good fit.